I. Introduction

I first came across Mark Miller’s work through Mark Conklin during a Shell–TriStar joint venture in Nashville, back when we were asking whether food service could fit inside the Twice Daily c-store brand. Conklin handed me The Secret, the book Miller wrote with Ken Blanchard, and in its pages I met the SERVE model [1]. If you’ve ever ordered a sandwich at Chick-fil-A and heard “How may we serve you?” you’ve tasted the philosophy: leadership as service, not posturing [2].

I regularly recommend the 10th-anniversary edition. You can read it in a weekend, but its real power comes when you hand out copies to fellow leaders on your team and wrestle with it together. It gives you a shared language, a way of arguing productively about what your team’s culture of leadership is supposed to look like.

That’s what I did with our Leadership Development Group of Houston, a circle of mid-level executives suddenly responsible for bigger teams and higher stakes. We used the SERVE mnemonic as our crucible for a year of monthly shared leadership studies, pulling apart its five letters, testing them against the fire of daily commercial decisions. What we found was a model simple enough to repeat, strong enough to hold. At the end of every day we could return to the same question: What did I learn today? and; How should I lead tomorrow?

The simplicity is what makes SERVE portable. It doesn’t require consultants, binders, or jargon. It works in real time, in the middle of market noise. And in commodity trading, where volatility never rests and reputational risk is always in play, that kind of compass is commercial survival.

The SERVE framework rests on five commitments:

S – See the Future

E – Engage and Develop Others

R – Reinvent Continuously

V- Value Results AND Relationships

E – Embody the Values

II. The SERVE Framework Applied to Commercial & Trading Leadership

See the Future

Leaders are often the team members with the ultimate responsibility to step away from the tactical grind of the day-to-day and look ahead. But that time is not free, it must be created by developing the next tier of leaders who can run the operation without constant supervision. Build that bench, and you buy yourself the luxury of foresight.

The act of looking ahead must be deliberate and regular, not occasional. Porter’s Five Forces is one useful map on which to place what we see when we look ahead to what is evolving in the market [3][4]. Anticipating shifts decides which people to hire, which assets to back, and where to place capital. In trading, foresight is the line between a reactive posture and a view-based mindset. The latter is how you place bets with conviction instead of chasing today’s prices.

Engage and Develop Others

Information decays as it travels up. Good news glides to the top, bad news gets filtered, softened, or buried. Engagement is the antidote. Skip-level conversations, town halls, open doors, these are ways to invite unvarnished truth. Reward people who surface hard facts, sometimes more than those who deliver easy wins.

I’ve long used the Four D’s: Do, Delegate, Develop, Defer. They force choices: what only you can do, what can be handed off, what grows capability, and what can wait. It’s not elegant, but it works. If I can’t delegate a task YET, then that becomes a target for developing the skill in my reports to be a future delegation candidate. Delegation helps your team learn by doing and buys the senior leader time to See the Future!

Listening is not a courtesy. It is a discipline. Patterns only emerge after enough conversations. Sit through the meetings, hear from analysts, traders, operators, customers. Taken together, the fragments reveal the picture.

Engagement is a flywheel. It grows people while sharpening foresight. It anchors leaders in reality.

Reinvent Continuously

A trading floor adage to remember, “What made money last quarter may not make a cent next quarter.” Markets shift too fast, edges decay. Reinvention is survival.

Unlike weather, which is chaotic but indifferent to your umbrella, markets are reflexive. They react to your moves. When one trader zigs, another zags. Sometimes everyone zags together. It is chaos with built in fast feedback loops.

Trading Leaders reinvent themselves to stay relevant to their teams. Trading Organizations reinvent strategies to stay relevant to the market. Some plays are shelved until conditions return, others are reworked, others killed. Those who cannot reinvent become liquidity for those who can.

The heroic lone trader is a recent relic. I am convinced that today’s advantage is built in integrated teams, front, middle, back office, supported by optimization, engineers, quants, analysts, and experienced senior leadership. Aramco Trading and Reliance Industries built networks that prove this “great team” theory. [8][9][10].

This is what research on collective genius also describes [5]. Leaders aren’t lone visionaries, they build systems where debate, test-and-learn cycles, and integrative choices thrive. Reinvention means holding playbooks lightly, ready to pivot as the world reacts to your reaction.

Value Results and Relationships

Results without relationships isolate. The market works around you. At the extreme, you get labeled “ABS”, as in … “Who should we trade in this opportunity with? ABS, Anyone But Steve” (or add in any letter/name)

Relationships without results are no better. Being nice without hitting your numbers is unsustainable. At some point the enterprise has to earn its keep.

The truth of commodity trading is that deals still come down to people. Models support, but they don’t shake hands. Trust, credibility, reputation, these are the grease in the gears. Results are the metal. Both are required.

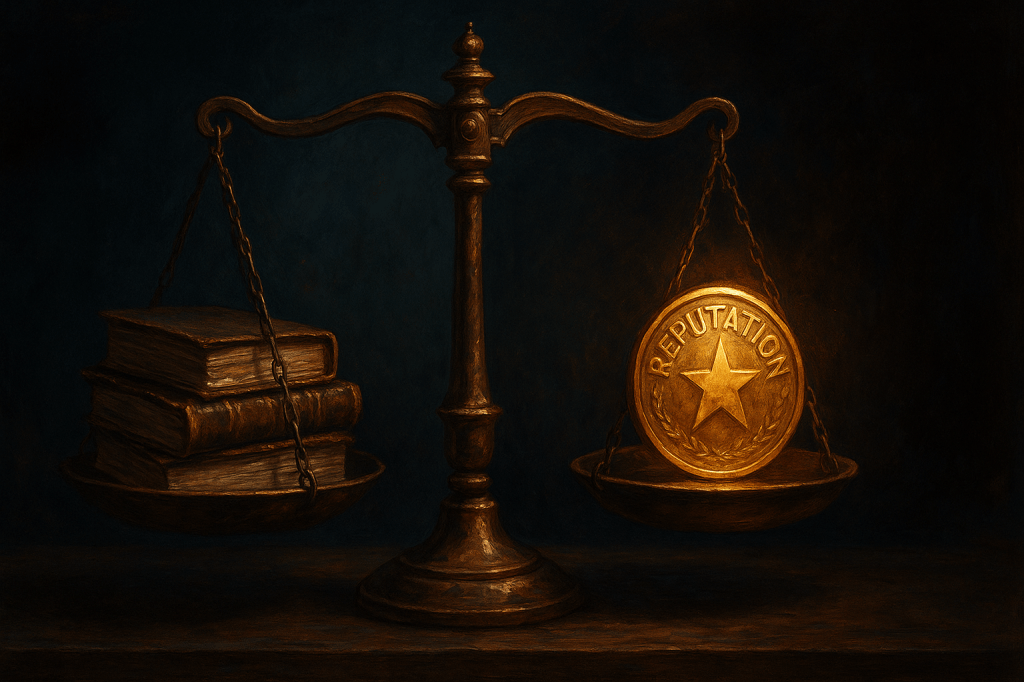

Embody the Values

Values spoken but not lived corrode trust. The gap between words and deeds is where credibility dies.

Acta non verba—deeds, not words.

Reputation in trading is the one account that compounds over decades. Everyone remembers who delivered in the hard moments. Everyone remembers who didn’t.

Living values is not moralism. It is risk management. In a world of compliance checks and regulatory oversight, consistency is both compass and shield. The record of aligned action becomes your defense when questions arise.

Culture follows example. A leader who embodies values sets the floor for behavior. Over time, the culture itself enforces the line.

Assets change, strategies turn, but the record of how you acted remains. That is the true account always being marked to market.

III. On Reflection

Two decades of commercial and trading leadership have only reinforced the value of SERVE. It began for me in a crucible with fellow young trading peers, but it scaled with me to trading floors and then to leadership in global trading networks.

What endured was the simplicity. In the noise of volatile markets, SERVE reduced leadership to five lenses. Not slide decks of theory, but daily questions. How do I see ahead? Who do I engage? What must I reinvent? How do I balance numbers and trust? Am I embodying what I preach?

I’ve seen foresight change the quality of bets, engagement pull hidden truths into daylight, reinvention keep teams from becoming obsolete. I’ve seen relationships without results collapse, and results without relationships turn toxic. And I’ve learned that values are not optional. They are the only guardrail that survives the cycle.

SERVE doesn’t promise success. No framework can. But it gives leaders a compass to orient themselves in the storm. That repeatable simplicity is why it endures.

In Conclusion and with thanks…

I owe thanks to Mark Miller and Ken Blanchard for putting SERVE into the world, and to Mark Conklin for bringing it into mine. What began as a slim volume has become a guiding line that I return to again and again. Its strength lies in its clarity: five practices simple enough to teach in an afternoon, strong enough to guide through a career of risk management and commercial profits.

For leaders on trading floors or in boardrooms, the crucible question remains: How should I lead today? SERVE doesn’t answer for you, but it focuses the lens you use to answer.

That is enough. And it is more than enough to change the way trading leadership is practiced.

End Notes

[1] Mark Miller & Ken Blanchard, The Secret: What Great Leaders Know and Do, 10th-anniversary ed. (includes updated leadership self-assessment).

https://www.markmillerleadership.com/product/the-secret-what-great-leaders-know-and-do

[2] Ken Blanchard, “What Great Leaders Know and Do: It’s All About the Values,” How We Lead.

https://howwelead.org/2014/11/12/what-great-leaders-know-and-do-its-all-about-the-values/

[3] Michael E. Porter, “The Five Forces,” Harvard Business School Institute for Strategy and Competitiveness.

https://www.isc.hbs.edu/strategy/business-strategy/Pages/the-five-forces.aspx

[4] Michael E. Porter, Competitive Strategy: Techniques for Analyzing Industries and Competitors (The Free Press, 1980). Standard reference for Five Forces framework.

[5] Linda A. Hill, Greg Brandeau, Emily Truelove, & Kent Lineback, Collective Genius: The Art and Practice of Leading Innovation, Harvard Business Review Press, 2014. Overview:

https://hbr.org/2014/06/collective-genius

[6] Warren B. Powell, Reinforcement Learning and Stochastic Optimization: A Unified Framework for Sequential Decisions (Wiley, 2022).

[7] Warren B. Powell, CASTLE Lab (latest work and research home page).

https://castle.princeton.edu/rlso/

[8] Aramco Trading Company, “Our Offices,” corporate site (Dhahran, Singapore, Fujairah, London, Houston).

https://www.aramcotrading.com/en/about-us/our-offices/

[9] Saudi Aramco, Annual Report 2024 (integrated trading footprint).

[10] Reliance Industries Limited, Corporate site (O2C strategy, Jamnagar Integrated Complex).

[11] Amy C. Edmondson, “Psychological Safety and Learning Behavior in Work Teams,” Administrative Science Quarterly 44, no. 2 (1999): 350–383.

[12] Amy C. Edmondson & Zhike Lei, “Psychological Safety: The History, Renaissance, and Future of an Interpersonal Construct,” Annual Review of Organizational Psychology and Organizational Behavior 1 (2014): 23–43.

https://www.annualreviews.org/content/journals/10.1146/annurev-orgpsych-031413-091305

[13] “Leaders, Don’t Be Afraid to Admit Your Flaws,” Kellogg Insight (2022).

https://insight.kellogg.northwestern.edu/article/leaders-dont-be-afraid-to-admit-your-flaws

[14] Li Jiang, Maryam Kouchaki, Leslie K. John, “Fostering Perceptions of Authenticity via Sensitive Self-Disclosure,” Organizational Behavior and Human Decision Processes 176 (2022): 104162.

https://pubmed.ncbi.nlm.nih.gov/36201838/

[15] Maryam Kouchaki, “Leaders, Don’t Be Afraid to Admit Your Flaws,” Kellogg Insight (2022).

https://insight.kellogg.northwestern.edu/article/leaders-dont-be-afraid-to-admit-your-flaws

[16] James R. Detert, Choosing Courage: The Everyday Guide to Being Brave at Work (Harvard Business Review Press, 2021). UVA Darden Ideas to Action summary:

https://ideas.darden.virginia.edu/workplace-courage-when-vulnerability-signals-strength

Leave a comment